EM Latin America reaction: Growth losing steam

- 30 April 2024 (3 min read)

KEY POINTS

Weak growth in Q4 across LatAm

Data published in the last weeks show that by the end of 2023, economic activity for Latin America was subdued, as Brazil, Colombia, and Mexico all reported modest growth in Q4 that fell short of market expectations. This broad deceleration can be attributed to several factors, including a natural tapering after the strong post-Covid rebound. Additionally, less supportive external conditions, such as slower growth in trading partners, tight global financing conditions, and declining commodity prices, along with the delayed effects of earlier domestic monetary tightening, have all contributed to this subdued performance across the region.

As we move through 2024, a dual narrative should emerge. Brazil and Mexico are expected to experience a leveling off in growth after surpassing expectations last year. Meanwhile, the economies of Chile and Colombia should gain momentum after a dismal performance in 2023. Despite these differing trajectories, what remains consistent is the convergence of these countries towards their respective low potential growth rates. This convergence raises the question of whether these potential growth rates have changed. Evidence of nearshoring initiatives in Mexico and a continual increase in oil production in Brazil, facilitated by liberalization measures in the sector, suggest that the remarkable growth seen last year in these two countries may signify deeper structural shifts rather than merely cyclical fluctuations. Similarly, several large mining projects are set to begin operations this year in Chile, which could boost its growth prospects in the short term.

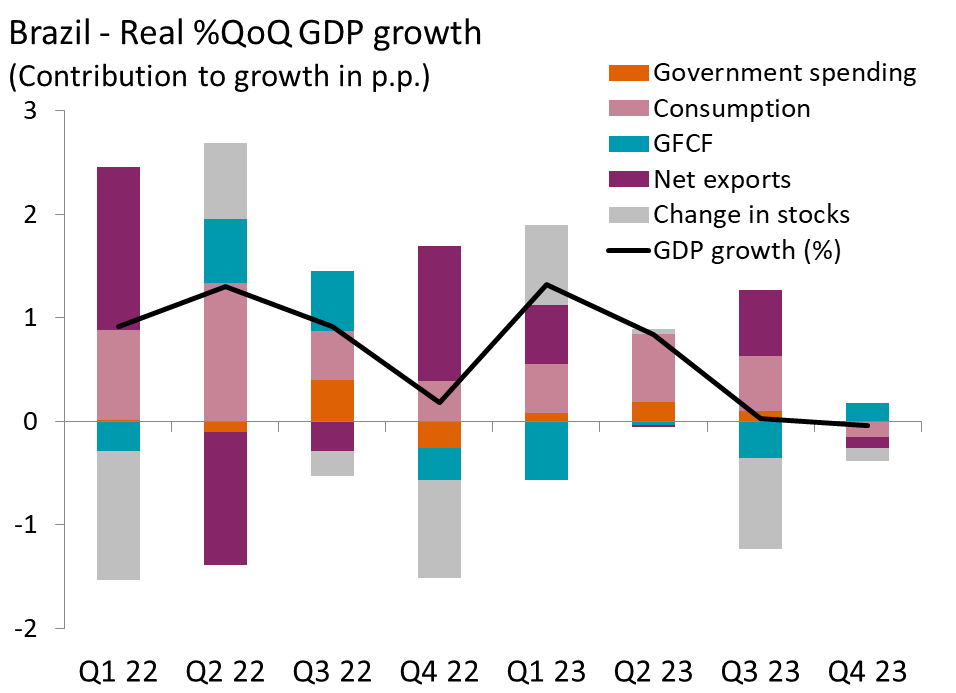

Brazil: Growth stagnant at end-2023

Real GDP growth came in flat (0.0% q/q sa) in Q4, down from 0.1% in Q3. Q4’s figure fell slightly below consensus expectations of 0.1% growth, marking the weakest performance since Q2 2021. On an annual basis, growth accelerated to 2.1% in Q4 (Q3:2.0%). With this result, Brazil recorded a 2.9% expansion for the full year of 2023, a better-than expected outturn compared to expectations at the beginning of last year thanks to an agricultural boom in Q1, higher government spending and a resilient job market.

The Q4 slowdown and contraction in private consumption, confirmed a sharp loss of momentum. The contraction in consumption, the first since Q2 2021, was the main drag on growth, with net exports also detracting from overall performance. Yet, higher government spending and a recovery in gross fixed capital formation (GFCF), the first growth since Q3 2022, helped partially offset these headwinds. In terms of output, the agriculture and livestock sector contracted for the third consecutive quarter in Q4, with services and industry showing growth, albeit at modest rates.

Looking ahead, we expect GDP growth to decelerate to 1.6% in 2024 as the effects of last year’s agricultural boom fades. Private consumption looks set to be the primary driver of growth this year, supported by a strong job market and more accommodative monetary policy, which should also help boost investment. However, the robust export growth seen in 2023 will likely ease this year due to weakening global demand for commodities, dampening overall growth. On a more positive note, there should be an important sequential reacceleration in the first half of the year as falling interest rates reignite growth in cyclical sectors like manufacturing, construction, and retail sales. For 2025, we foresee growth reaching 2.0%, in line with Brazil’s potential growth rate.

Colombia: Disappointing growth in Q4

Colombia's economy also fell short of expectations, registering a significant slowdown to 0.0% quarter-on-quarter seasonally adjusted in Q4 from Q3's 0.3% figure. Year-on-year growth picked up to 0.3%, up from Q3's -0.6%. The overall picture for 2023 was dismal, with growth a mere 0.6% for the full year, in stark contrast to the robust 7.3% expansion seen in 2022. This weak performance, the worst since 1999 (barring 2020), is largely the result of a tight policy mix aimed at correcting Colombia's macroeconomic imbalances that had accumulated during the post-Covid rebound.

Positive contributions to growth came from changes in inventories and a resurgence in private consumption, which rebounded after three consecutive quarters of contraction. However, GFCF remained a significant drag on growth, struggling in a high-interest environment. Government spending and net exports also weighed on growth in Q4. From an output perspective, agriculture and public services drove economic activity, while manufacturing lagged as the primary drag.

Colombia’s sluggish momentum is set to persist well into 2024 as the economy continues to grapple with contractionary monetary policy and low consumer confidence. We expect the economy to gain steam towards the second half of the year as macroeconomic policies gradually normalize, pushing growth to 1.5% for the year. Private consumption will benefit from falling inflation and lower interest rates. Likewise, a looser monetary stance should allow investment to recover after contracting all throughout 2023. However, the external sector will remain subdued by weaker global demand and stagnant oil production. For 2025, we see the economy continuing to recover and grow 2.5%.

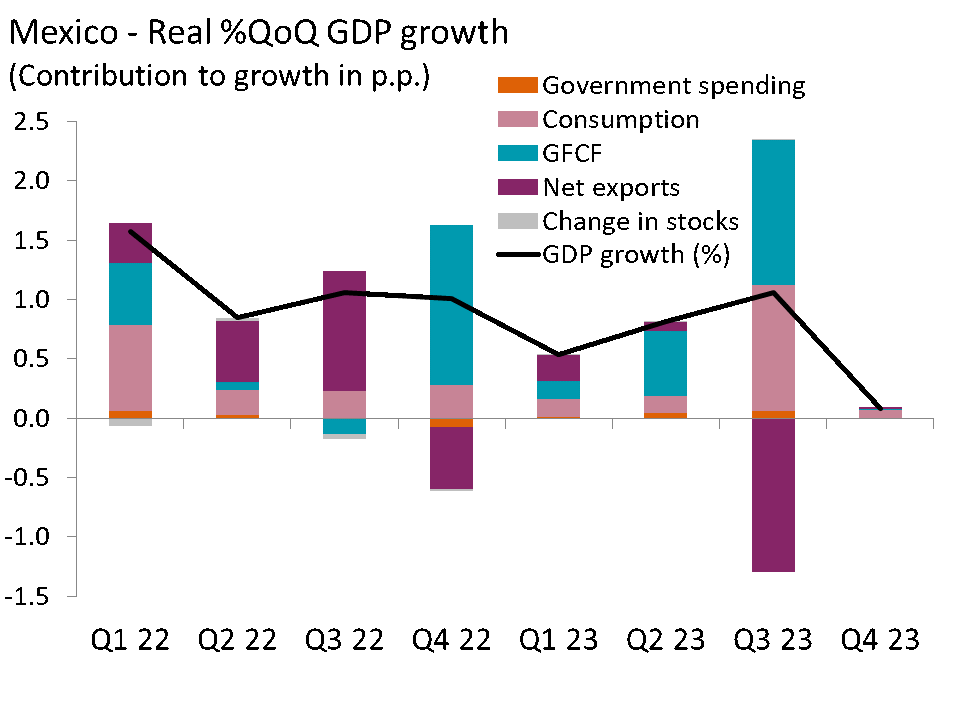

Mexico: Economy decelerates in Q4

The Mexican economy decelerated to 0.1% in Q4 from 1.1% in Q3. The figure surprised to the downside and marked the weakest increase since Q3 2021. On an annual basis, economic activity slowed to 2.4%, below Q3’s 3.3% growth. Despite the disappointing Q4 data, the economy expanded by an annual 3.2% over 2023, the best performance among major countries in the region. This resilience reflected a strong labor market (unemployment is hovering around record-low rates) and higher-than-expected growth of the US economy.

The deceleration in Q4 was broad-based, with all GDP components slowing on a quarter-on-quarter basis except for net exports, which rebounded after contracting in Q3. Nonetheless, private consumption remained the main growth pillar, contributing almost 80% to the overall Q4 GDP reading. From a supply-side perspective, economic activity seemed to be mainly driven by the secondary sector (including mining, construction, and utilities), followed by the tertiary sector (retail and services). Meanwhile, the primary sector (agriculture, animal husbandry, fishing, etc.) remained stable in Q4.

In 2024, we expect the economy will continue to grow slightly above potential, cooling to 2.2% despite a significant increase in government spending ahead of June’s presidential elections. With more money injected into social programs and public infrastructure, the economy should maintain its positive momentum in the first half of the year. However, growth could start to falter in the second half as tight monetary policy persists and growth in the US, Mexico’s main trading partner, begins to slow. Nevertheless, there's potential for a boost in economic activity in Mexico through ongoing nearshoring efforts. For 2025, we expect growth to reach 2.1% although developments in US Presidential Elections will need to be followed closely.

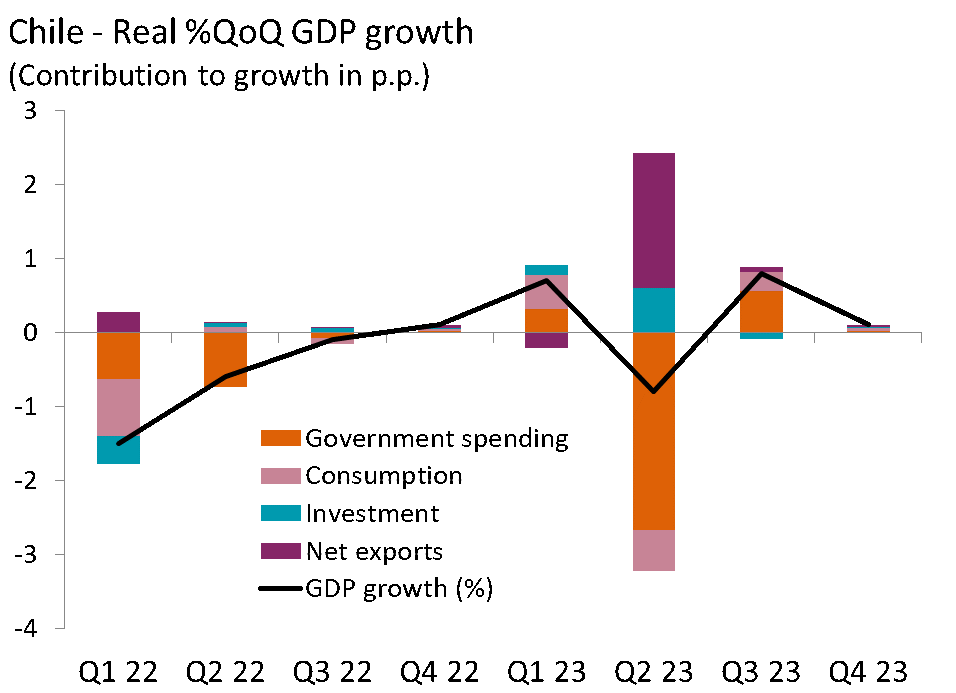

dChile: Contraction narrowly avoided in 2023

Chile's Q4’ performance surprised to the downside with GDP growth decelerating to 0.1% quarter-on-quarter seasonally adjusted, down from Q3's 0.3%. year-on-year growth also slowed to 0.4% compared to Q3’s 0.6%. Despite these challenges, Chile managed to surpass expectations for the full-year 2023, recording a modest growth of 0.2%. This outcome can be partly attributed to upward revisions in GDP readings for Q1 and Q2. Nevertheless, Chile still lagged other major Latin American economies in 2023 due to a series of challenges such as high interest rates, mining production issues, and low business confidence.

In Q4, growth was mainly driven by private consumption and government spending, which reversed their contractions from Q3. However, investment and net exports remained largely subdued. On the supply side, personal services and transport categories made the most significant contributions to Q4 growth, while the mining sector, vital for Chile's economy, contracted at the end of the year.

Chile’s economy is approaching the end of its adjustment cycle and should start converging towards trend growth, with projected growth rates of 1.5% in 2024 and 2% in 2025. Private consumption should drive growth this year supported by lower inflation, looser monetary policy, and increased political stability after years of turmoil, which should also benefit investment. Likewise, the economy is set to receive a boost from mining exports, as large mining projects are slated to start operating this year. However, Chile's economic outlook could face a significant risk from a potential slowdown in China, given its role as Chile's main trading partner.

Source: AXA IM research, March 2024

Source: AXA IM research, March 2024

Source: AXA IM research, March 2024

Source: AXA IM research, March 2024

All data sourced from AXA Investment Managers, March 2024.

Risk Warning

Investment involves risk including the loss of capital.

The information has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. This analysis and conclusions are the expression of an opinion, based on available data at a specific date. Due to the subjective aspect of these analyses, the effective evolution of the economic variables and values of the financial markets could be significantly different for the projections, forecast, anticipations and hypothesis which are communicated in this material.

Disclaimer

This document is being provided for informational purposes only. The information contained herein is confidential and is intended solely for the person to which it has been delivered. It may not be reproduced or transmitted, in whole or in part, by any means, to third parties without the prior consent of the AXA Investment Managers US, Inc. (the “Adviser”). This communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

© 2024 AXA Investment Managers. All rights reserved.